TRUTH WALTON

Student of the Market

Saturday, 8 February 2020

Saturday, 23 November 2019

Saturday, 31 August 2019

Friday, 12 July 2019

The Queen Does Not Tolerate Negative Interest Rates

Central Bank Rates and 10-Year yields in Britain and the Commonwealth appear to be immune to the negative interest plague.

All former British Colonies' interest rates are greater than or equal to 0.71%.

Fair to say the Queen isn't sold on the virtues of Negative Interest Rate Policy.

Central Bank Rates in Britain and the Commonwealth States (Australia, Canada, New Zealand) Trailing 20 Years (%)

10-Year Yields, 2005-2019 (%)

The $12 Trillion or so in negative sovereign bond yields is so far restricted to the EU and Japan.

All former British Colonies' interest rates are greater than or equal to 0.71%.

Fair to say the Queen isn't sold on the virtues of Negative Interest Rate Policy.

Central Bank Rates in Britain and the Commonwealth States (Australia, Canada, New Zealand) Trailing 20 Years (%)

10-Year Yields, 2005-2019 (%)

The $12 Trillion or so in negative sovereign bond yields is so far restricted to the EU and Japan.

Saturday, 6 July 2019

Interest Rates: Central Bank Rate Spreads Highest in Over 20 Years

Equally as curious as the new negative interest rate phenomenon is the generous spreads between official Central Bank Policy Rates.

Central Bank Rates:

USD <2.50%

CAD 1.75%

GBP 0.75%

JPY -0.10%

EUR -0.36%

USD-EUR spread = 286bps.

Points of note:

1. The Fed leads the pack (first to act) in terms of interest rate policy, followed by Canada then Britain. Fed policy is a good predictor of global central bank policy.

2. Beginning 2017, The Fed hikes interest rates 8 times, the BOC 5 times and the BOE 2 times; while the BOJ leaves rates unchanged and the ECB actually cuts interest rates further into negative territory.

3. The spread between Central Bank Policy Rates is widest in over 20 years. Post-2008 "central bank policy coordination," is the unofficial policy mantra among policymakers, which implies an eventual conversion of interest rates. This means either The Fed cuts interest rates by about 250bps, or the ECB and BOE hike by a similar amount.

One thing is for sure: interest rate divergences this wide won't last forever.

USD, CAD, GBP, BOJ, & ECB Relative Interest Rate Performance

USD (Blue) vs EUR (Beige) Interest Rate Performance - 275bps Spread

Central Bank Rates:

USD <2.50%

CAD 1.75%

GBP 0.75%

JPY -0.10%

EUR -0.36%

USD-EUR spread = 286bps.

Points of note:

1. The Fed leads the pack (first to act) in terms of interest rate policy, followed by Canada then Britain. Fed policy is a good predictor of global central bank policy.

2. Beginning 2017, The Fed hikes interest rates 8 times, the BOC 5 times and the BOE 2 times; while the BOJ leaves rates unchanged and the ECB actually cuts interest rates further into negative territory.

3. The spread between Central Bank Policy Rates is widest in over 20 years. Post-2008 "central bank policy coordination," is the unofficial policy mantra among policymakers, which implies an eventual conversion of interest rates. This means either The Fed cuts interest rates by about 250bps, or the ECB and BOE hike by a similar amount.

One thing is for sure: interest rate divergences this wide won't last forever.

USD, CAD, GBP, BOJ, & ECB Relative Interest Rate Performance

USD (Blue) vs EUR (Beige) Interest Rate Performance - 275bps Spread

Labels:

Dow Jones Industrial Average,

Fed,

Interest Rates,

Monetary Policy,

S&P 500,

Stocks,

USD

Macro Fundamentals: Interpreting Friday's Jobs Numbers

Do you know why the June Unemployment Rate increased a tenth of a percent from 3.6% to 3.7%?

Because the Labor Force Participation Rate also increased: i.e., more and more people are entering the Labor Force. People who've quit looking for jobs in the past are now actively seeking employment again.

Only those actively seeking employment get counted in the official unemployment rate; the more people there are seeking employment, the more people there are being counted as unemployed. (Job seekers that drop out of the labor market (stop searching) are excluded from the official number.)

So, the actual rate of unemployed people didn't increase; there's just a greater number of job seekers included in the sample.

To the casual observer, an uptick in the Unemployment Rate appears to be a negative development, but that is not the case.

Market effect

Traders view the number of unemployed people as a general signal of overall economic health, as consumer spending is highly correlated with labor-market conditions, and is also a major consideration for monetary policy at The Fed.

Investors tend to interpret the Unemployment Rate in relation to the LF Participation Rate as follows:

Unemployment Rate ↑ + Labor Force Participation Rate ↑ = +

Unemployment Rate ↑ + LFP Rate ↓ = -

Unemployment Rate ↓ + LFP Rate ↓ = +/-

Unemployment Rate ↓ + LFP Rate ↑ = ++

By forming a general but comprehensive view of fundamental economic data and getting a sense of the potential market implications a trader adds a valuable tool to his tool-belt

Because the Labor Force Participation Rate also increased: i.e., more and more people are entering the Labor Force. People who've quit looking for jobs in the past are now actively seeking employment again.

Only those actively seeking employment get counted in the official unemployment rate; the more people there are seeking employment, the more people there are being counted as unemployed. (Job seekers that drop out of the labor market (stop searching) are excluded from the official number.)

So, the actual rate of unemployed people didn't increase; there's just a greater number of job seekers included in the sample.

To the casual observer, an uptick in the Unemployment Rate appears to be a negative development, but that is not the case.

Market effect

Traders view the number of unemployed people as a general signal of overall economic health, as consumer spending is highly correlated with labor-market conditions, and is also a major consideration for monetary policy at The Fed.

Investors tend to interpret the Unemployment Rate in relation to the LF Participation Rate as follows:

Unemployment Rate ↑ + Labor Force Participation Rate ↑ = +

Unemployment Rate ↑ + LFP Rate ↓ = -

Unemployment Rate ↓ + LFP Rate ↓ = +/-

Unemployment Rate ↓ + LFP Rate ↑ = ++

By forming a general but comprehensive view of fundamental economic data and getting a sense of the potential market implications a trader adds a valuable tool to his tool-belt

Sunday, 26 May 2019

American Entrepreneurs: Rupert Murdoch

Rupert Murdoch: The Untold Story of the World's Greatest Media Wizard by Neil Chenoweth https://archive.org/details/rupertmurdochunt00chen

Rupert Murdoch: The Untold Story of the World's Greatest Media Wizard by Neil Chenoweth https://archive.org/details/rupertmurdochunt00chen Saturday, 18 May 2019

American Entrepreneurs: Sam Walton

In Sam We Trust: The Untold Story of Sam Walton and Wal-Mart, the World's Most Powerful Retailer by Bob Ortega https://www.amazon.com/dp/0812932978/ref=cm_sw_r_tw_dp_U_x_Q1i4Cb3W6Q6MY

Labels:

American business,

corporate governance,

Entrepreneurship,

retail,

Trade,

USA,

Wal-Mart

Thursday, 18 April 2019

Money Supply: Obama vs Trump

The Fed controls the Money Supply.

Here's the monetary base vs the S&P 500 (SPX) during Obama yrs vs President Trump's first term so far:

Obama (+346%)

Decline in the Money Supply since November 2018: -6.6%

Here's the monetary base vs the S&P 500 (SPX) during Obama yrs vs President Trump's first term so far:

Obama (+346%)

Decline in the Money Supply since November 2018: -6.6%

Underreported

The Capacity Utilization Rate is highest in four years.

You will not have a recession without a declining capacity utilization rate, no matter what the yield curve is doing, or how Europe or China is doing.

Related data points released today:

- U.S. Retail Sales m/m: 1.6% (0.9% exp)

- German Manufacturing PMI (Apr): 44.5 (45.2 exp) [< 50 signals contraction]

- Eurozone Manufacturing PMI (Apr): 47.8 (48 exp)

- Eurozone Services PMI (Apr): 52.5 (53.1 exp)

- Eurozone Composite PMI (Apr): 51.3 (51.8 exp)

You will not have a recession without a declining capacity utilization rate, no matter what the yield curve is doing, or how Europe or China is doing.

Related data points released today:

- U.S. Retail Sales m/m: 1.6% (0.9% exp)

- German Manufacturing PMI (Apr): 44.5 (45.2 exp) [< 50 signals contraction]

- Eurozone Manufacturing PMI (Apr): 47.8 (48 exp)

- Eurozone Services PMI (Apr): 52.5 (53.1 exp)

- Eurozone Composite PMI (Apr): 51.3 (51.8 exp)

Saturday, 13 April 2019

Buffett’s Alpha

Warren Buffett’s Berkshire Hathaway has realized a Sharpe ratio of 0.79 with significant alpha to traditional risk factors. The alpha became insignificant, however, when we controlled for exposure to the factors “betting against beta” and “quality minus junk.” Furthermore, we estimate that Buffett’s leverage is about 1.7 to 1, on average. Therefore, Buffett’s returns appear to be neither luck nor magic but, rather, a reward for leveraging cheap, safe, high-quality stocks. Decomposing Berkshire’s portfolio into publicly traded stocks and wholly owned private companies, we found that the public stocks have performed the best, which suggests that Buffett’s returns are more the result of stock selection than of his effect on management.

Link to full text

Re: Ridiculous Buffett

Performance since 2013: Buffett vs the S&P 500 benchmark:

Berkshire Hathaway (BRK/A) +125.09% (+17.62% CAGR).

S&P 500 (SPY) +98.66% (+14.72% CAGR).

Performance since 2008 (year of the Great Recession):

BRK/A +137.89% (+16.12% CAGR).

SPY +107.04% (+7.55% CAGR).

Performance since 2003:

BRK/A +345.75% (10.48% CAGR).

SPY +211.80% (7.88% CAGR).

Berkshire Hathaway (BRK/A) +125.09% (+17.62% CAGR).

S&P 500 (SPY) +98.66% (+14.72% CAGR).

Performance since 2008 (year of the Great Recession):

BRK/A +137.89% (+16.12% CAGR).

SPY +107.04% (+7.55% CAGR).

Performance since 2003:

BRK/A +345.75% (10.48% CAGR).

SPY +211.80% (7.88% CAGR).

Quitters Always Win

"I've failed over and over again in my life, and that is why I succeed."

— Michael Jordan

Last Thursday, before the last game of the season, Magic suddenly decides to announce his resignation as President of Los Angeles Lakers. The PR people are baffled and media is surprised. The decisive move comes as a shock to everyone, and Magic explains the reasons for his actions to the reporters. Subsequently, media unanimously dismisses the decision as a cop-out, and the choir synchronously labels Magic Johnson a "quitter."

But Traders can learn a few valuable lessons from Magic's abrupt decision to step down. Other than the fact that there's value in quitting and quitting fast (when you're wrong), what can we learn from a quitter who has managed to accumulate just under a Billion dollars over the course of his life?

1. When it's time to cut your loss—cut it. Don't hesitate or have second thoughts or begin to rely on hope. One of the main reasons for cutting your loss is to free up idle capital to allocate to a better trade. A loss isn't a benefit at any time. The sooner you dump it the better. In trading and in life.

2. Make the decision to cut the loss no matter what the inner impulses say; even if it's the hardest thing to do. (Once you cut your loss, you're no longer wrong nor losing.)

3. Embrace being wrong. Magic knows he isn't delivering as promised (a lot of bad trades and an excellent trade gone bad) and willingly admits to it. This is why Magic is a big man. It takes a big man to admit when he's wrong. The greatest traders/investors admit to being wrong more often than they brag about being right.

4. Face the music. Keep your chin up when you lose and don't look at yourself as any less of a man for it. Magic's decision to resign in public and in front of the cameras takes...guts. Most people quit via resignation letter or over the phone. Magic shows up and shows you his face and let's you see what it is. Facing the music by being open about your losses is the ultimate form of transparency, and has a lot to do with Accountability, Integrity and Achievement.

5. Ignore stupid people. If you pay attention to random critics, you end up living for other people. Independent thinking is mandatory for the speculator and the investor. Despite attempts from the media to shame Magic into maybe giving it a second thought, you can bet the decision is final. Successful traders quit positions all the time, but they don't take tips.

The gist: by always sticking to the basics, cutting losses short, you're always in the position to have enough dry powder to be able to cash in on the big trade, when it finally comes around.

Friday, 5 April 2019

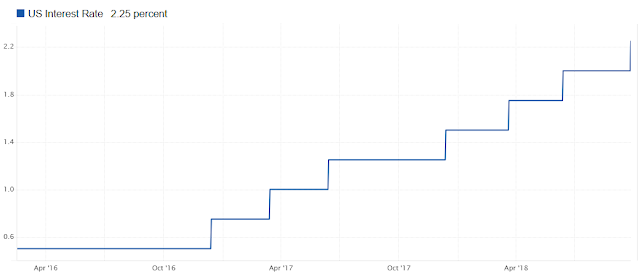

Is Trump Crazy on Interest Rates?

The media agrarians are now pushing the line of: "If the economy is so strong, like you boast, Mr. President, then why should the Fed cut interest rates?"

The line, and the others similar to it, are meant to suppose that either the economy is not really strong, and the President is a liar (like every politician to ever bless a crowd), or that it is strong and the President is an imbecile, who doesn't understand a lick of economics.

The reality is that Fed has been on a psycho-spasm of nine consecutive rate hikes the moment Trump was elected (which just ended in December with one final 25bps hike) after not raising rates even once for ten consecutive years.

If the Trump Bump is "fake" and just a "sugar high," (as the Ministry of Truth tells us every day) then why would the Fed suddenly hike nine consecutive times after not hiking once over a ten-year period? Makes no sense whatsoever. No other central bank raised rates.

What happened to "global central bank coordination"?

The Fed can't point to anything to explain its actions, so it's fair to conclude the actions were political/anti-Trump... If that's the case, they ought to return to their previous policy of "central bank coordination," wherein which all central banks move interest rates up or down in unison, not just the Fed.

Why have all central banks stood pat on interest rates (other than little brother Canada that just follows the Fed) while the Fed hiked nine consecutive times?

Because raising rates slows economic activity... So what did Fed's actions do to the U.S. economy?

Slowed it down. So the U.S. is technically overbought on interest rates, compared to the rest of the world.

When it comes to economics, everything is relative—and interest rates are just a reflection of inflation. Nominal rates mean nothing on their own. So when you see Trump's economic advisor saying the Fed needs to cut interest rates, while rates are at 2.75%, always consider both the current rate of inflation and central bank rates in other developed countries (primarily the ECB and BOJ). If the real interest rate (nominal interest rate - inflation rate) is at or near 0%, there's nothing to see/nothing out of the norm. If they begin to deviate from zero percent, then there's something to discuss (and a potential trading opportunity).

When interest rates were at 15%, what do you think inflation was at? 15%. So real interest rate = 0%.

Now that interest rates are at 2.75%, what do you think inflation is at? Just about 2.50-2.75%. So the real interest rate is just about 0%.

Why most governments have a monetary policy that keeps real interest rates at 0% is different subject and a discussion for another day.

The line, and the others similar to it, are meant to suppose that either the economy is not really strong, and the President is a liar (like every politician to ever bless a crowd), or that it is strong and the President is an imbecile, who doesn't understand a lick of economics.

The reality is that Fed has been on a psycho-spasm of nine consecutive rate hikes the moment Trump was elected (which just ended in December with one final 25bps hike) after not raising rates even once for ten consecutive years.

If the Trump Bump is "fake" and just a "sugar high," (as the Ministry of Truth tells us every day) then why would the Fed suddenly hike nine consecutive times after not hiking once over a ten-year period? Makes no sense whatsoever. No other central bank raised rates.

What happened to "global central bank coordination"?

The Fed can't point to anything to explain its actions, so it's fair to conclude the actions were political/anti-Trump... If that's the case, they ought to return to their previous policy of "central bank coordination," wherein which all central banks move interest rates up or down in unison, not just the Fed.

Why have all central banks stood pat on interest rates (other than little brother Canada that just follows the Fed) while the Fed hiked nine consecutive times?

Because raising rates slows economic activity... So what did Fed's actions do to the U.S. economy?

Slowed it down. So the U.S. is technically overbought on interest rates, compared to the rest of the world.

When it comes to economics, everything is relative—and interest rates are just a reflection of inflation. Nominal rates mean nothing on their own. So when you see Trump's economic advisor saying the Fed needs to cut interest rates, while rates are at 2.75%, always consider both the current rate of inflation and central bank rates in other developed countries (primarily the ECB and BOJ). If the real interest rate (nominal interest rate - inflation rate) is at or near 0%, there's nothing to see/nothing out of the norm. If they begin to deviate from zero percent, then there's something to discuss (and a potential trading opportunity).

When interest rates were at 15%, what do you think inflation was at? 15%. So real interest rate = 0%.

Now that interest rates are at 2.75%, what do you think inflation is at? Just about 2.50-2.75%. So the real interest rate is just about 0%.

Why most governments have a monetary policy that keeps real interest rates at 0% is different subject and a discussion for another day.

Sunday, 24 March 2019

Why U.S. Stocks are a Good Long-Term Investment

Below is a chart of the Dow Jones Industrial Average (DJIA); note the total percentage gain over the past 105 years: 39249.36%.

A $10,000 investment in the DJIA index (ticker symbol: DIA) 105 years ago is worth to $3.4 million today. A 39249.36% increase, (373.80 percent annual rate of return).

Over the past 30 years, the DJIA has increased 1254.22% (a 41% annual rate of return - better than Warren Buffett's 65-year career average of 23%). A $10,000 investment in the Dow Jones 30 years ago is worth $135,400 today.

Looking at it a different way, a $100,000 investment in the Dow in 1988—say, at the age of 20—is now worth $1.4 million and you're now a 50-year-old millionaire with an option to retire early.

DJIA 30-year (1988 - 2019) performance (%):

The point here: U.S. stocks make good long-term investments.

A $10,000 investment in the DJIA index (ticker symbol: DIA) 105 years ago is worth to $3.4 million today. A 39249.36% increase, (373.80 percent annual rate of return).

Over the past 30 years, the DJIA has increased 1254.22% (a 41% annual rate of return - better than Warren Buffett's 65-year career average of 23%). A $10,000 investment in the Dow Jones 30 years ago is worth $135,400 today.

Looking at it a different way, a $100,000 investment in the Dow in 1988—say, at the age of 20—is now worth $1.4 million and you're now a 50-year-old millionaire with an option to retire early.

DJIA 30-year (1988 - 2019) performance (%):

The point here: U.S. stocks make good long-term investments.

Thursday, 14 March 2019

Tuesday, 12 February 2019

Berkshire Hathaway (BRK) vs S&P 500 Index (SPX)

Why Warren Buffett is the Greatest Investor in Modern History:

Berkshire Hathaway +3669.89% vs S&P 500 Index +678.74%, 1990 - Present:

When you outperform the S&P 500 for 29 years and do it by a factor greater than 4, you're the Michael Jordan (or Warren Buffett) of investing.

Berkshire Hathaway +3669.89% vs S&P 500 Index +678.74%, 1990 - Present:

When you outperform the S&P 500 for 29 years and do it by a factor greater than 4, you're the Michael Jordan (or Warren Buffett) of investing.

Thursday, 7 February 2019

Quote From 'Reminscences of a Stock Operator'

This is in the context of Livermore recounting the fact that he discovers that he wins whenever his trades are based on precedent he wins, and when they're based on blind impulses he loses.

A quote to remember whenever the gambling instinct arises:

A quote to remember whenever the gambling instinct arises:

"The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages."

Wednesday, 6 February 2019

Finance: The Time Value of Money

Inflation and the Time Value of Money:

Definition of inflation: Rate at which prices as a whole are increasing.

When a bank offers to pay 6 percent on a savings account, it promises to pay interest of $60 for every $1,000 you deposit. The bank fixes the number of dollars that it pays, but it doesn’t provide any assurance of how much those dollars will buy. If the value of your investment increases by 6 percent, while the prices of goods and services increase by 10 percent, you actually lose ground in terms of the goods you can buy.

Tuesday, 5 February 2019

Dollar Stiff as a Board

Fed goes from 3 hikes 0 hikes in a matter of weeks, fastest U-turn in history made by the largest central bank in the world, and USD stiff as a board. tells me a lot.

Hate to see what happens to Euro during next recession. Sub-zero interest rate policy or more Quantitative Easing only option. Sub-zero rates only untried policy option of the two.

Real GDP +3.4% and that's all that really matters at the end of the day for the U.S; though, Fed's U-turn could imply 3.4% is tentative.

Note: Fed in relatively safe position compared to ECB and BOJ in terms of policy preparedness for next recession. ECB and BOJ are elephant in room. This sets table for bid Dollar near/medium-term.

Hate to see what happens to Euro during next recession. Sub-zero interest rate policy or more Quantitative Easing only option. Sub-zero rates only untried policy option of the two.

Real GDP +3.4% and that's all that really matters at the end of the day for the U.S; though, Fed's U-turn could imply 3.4% is tentative.

Note: Fed in relatively safe position compared to ECB and BOJ in terms of policy preparedness for next recession. ECB and BOJ are elephant in room. This sets table for bid Dollar near/medium-term.

Monday, 4 February 2019

Sunday, 3 February 2019

Thursday, 10 January 2019

Tuesday, 8 January 2019

Monday, 7 January 2019

Equity Analyst Translations

Equity Analyst ratings changes in plain English:

"Buy" → I have a friend that needs to unload.

"Hold" → I gotta get paid for doing something, so here it is.

"Sell" → I have a friend that wants to load the boat.

"Sector Perform" → Gotta write something about this, so here.

"Outperform" → I have a friend that needs to unload but he isn't that important.

"Underweight" → This thing was a POS from the get go.

"Overweight" → Best house in a shitty neighbourhood. "

"Price Target Lowered" → We're dumber than we first thought.

"Price Target Raised" → Everyone else is raising it, so we are. Besides, chart says momentum is building up.

"Buy" → I have a friend that needs to unload.

"Hold" → I gotta get paid for doing something, so here it is.

"Sell" → I have a friend that wants to load the boat.

"Sector Perform" → Gotta write something about this, so here.

"Outperform" → I have a friend that needs to unload but he isn't that important.

"Underweight" → This thing was a POS from the get go.

"Overweight" → Best house in a shitty neighbourhood. "

"Price Target Lowered" → We're dumber than we first thought.

"Price Target Raised" → Everyone else is raising it, so we are. Besides, chart says momentum is building up.

Wednesday, 28 November 2018

Bitcoin: Everybody Gets What They Want

"Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win by losing money." - Ed SeykotaBecause someone has to say it: Bitcoin and all its securitized mutations are designed to facilitate the transfer of capital from less intelligent people to more intelligent people. None Left Behind policy means this transaction can be done in less than one ten-thousandth of a bitcoin.

Below: Annual relative performance for some of the more popular bitcoin derivatives: BTC, GBTC, BCII, LBCC, LFIN

Monday, 26 November 2018

6 Near-Term Bullish Catalysts for Stocks

Ten days ago, I couldn't think of one near-term bullish catalyst for stocks.

Today, I can think of six:

1. Backdrop of general hollow ambience. [no good news, no bad news, not much new news at all.]

2. Santa Claus rally.

3. An easier, more Dovish, Fed.

4. Frequency of anti-prez headlines makes unexpected return after the holiday weekend.

5. Frequency of Eamon Jabbers appearances on CNBC.

6. Stocks closed up for the month 17 of last 20 Decembers.

Potential confirming catalyst: Several intra-day Nike Checks as evidence of near-term bull rush — sponsored by peppered short squeezes.

Could be enough force to push stocks within range of ATHs before year end. IMO, that will mark the end of the ten-year bull run.

Today, I can think of six:

1. Backdrop of general hollow ambience. [no good news, no bad news, not much new news at all.]

2. Santa Claus rally.

3. An easier, more Dovish, Fed.

4. Frequency of anti-prez headlines makes unexpected return after the holiday weekend.

5. Frequency of Eamon Jabbers appearances on CNBC.

6. Stocks closed up for the month 17 of last 20 Decembers.

Potential confirming catalyst: Several intra-day Nike Checks as evidence of near-term bull rush — sponsored by peppered short squeezes.

Could be enough force to push stocks within range of ATHs before year end. IMO, that will mark the end of the ten-year bull run.

Sunday, 25 November 2018

Friday, 23 November 2018

Tuesday, 6 November 2018

Monday, 22 October 2018

Sunday, 21 October 2018

Four Rules of Speculation from the Oldest Book on Speculation

"The first rule in speculation is: Never advise anyone to buy or sell shares. Where guessing correctly is a form of witchcraft, counsel cannot be put on airs.

"The second rule: Accept both your profits and regrets. It is best to seize what comes to hand when it comes, and not expect that your good fortune and the favorable circumstances will last.

"The third rule: Profit in the share market is goblin treasure: at one moment, it is carbuncles, the next it is coal; one moment diamonds, and the next pebbles. Sometimes, they are the tears that Aurora leaves on the sweet morning's grass, at other times, they are just tears.

"The fourth rule: He who wishes to become rich from this game must have both money and patience."

Saturday, 20 October 2018

Friday, 19 October 2018

Five Livermore Quotes on Overtrading

"Many men in Wall Street, who are not at all in the sucker class, not even in the third grade, nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight."

"Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money."

"The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages."

"After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!"

"Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money."

"The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages."

"There is the plain fool...but there is the Wall Street fool, who thinks he must trade all the time. No man can always have adequate reasons for buying or selling stocks daily or sufficient knowledge to make his play an intelligent play."

"After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!"

Thursday, 18 October 2018

Technical View of Where Stocks Go from Here (15-Oct-2018)

Lots of investors use the SMA200 (daily) or SMA40 (weekly)

as the definitive line that separates a bull market from a bear market.

Currently, this price level is 2769.

Clusters of stops are placed above and below, so I wouldn't be surprised to see choppy price action within a range of roughly 1.5 X the weekly ATR +/- over the next few weeks, as bulls and bears wrestle for position.

One has a hunch that it's the perfect time for the "spite long" trade: taking the opposite side of overzealous perma-bears purely out of spite. They've been out in full force recently and are usually the best contra-indicators.

Currently, this price level is 2769.

Clusters of stops are placed above and below, so I wouldn't be surprised to see choppy price action within a range of roughly 1.5 X the weekly ATR +/- over the next few weeks, as bulls and bears wrestle for position.

One has a hunch that it's the perfect time for the "spite long" trade: taking the opposite side of overzealous perma-bears purely out of spite. They've been out in full force recently and are usually the best contra-indicators.

Monday, 15 October 2018

Reasons to Doubt a Continuation of Last Week's Selloff (Outline)

A few factors to consider before committing to the bear side.

Qualitative:

1. majority of market is on high alert/risk off and had a lot of time to settle into their thoughts over the weekend. They all fear a Monday gap-down and likely have stops in place to limit any potential downside in their portfolios.

2. Santa Clause Rally - we are currently in prime time for a holiday-fueled rally in stocks.

3. Trump leveling up public criticism of Fed policy.

4. The Perma-Bears are out in full force with more conviction than ever. From the Schiffs to the Stockmans - they've all published articles and videos over the weekend prophesying that last week's move is just the beginning of the end. This usually marks a near-term bottom. I wouldn't enter any new shorts while the bears have their chests puffed out.

Quantitative:

1. October's CPI came in 50% below forecasts. The CPI is the Fed's primary tool for gauging near term inflation, and a print 50% below expectations is not bullish for rates.

2. Jobless claims came in 7K higher than expected. One data point does not a trend make, however, it is technically inconsistent with a tightening labour market.

3. Strong dollar exacerbating slowdown in global growth. Since the Fed's dot plots imply a gradually strengthening dollar, current interest rate policy risks triggering a wave of emerging market debt defaults. Ironically, a slowdown in global growth itself ignites a flight to safety, strengthen the dollar further from here, irrespective of a change in monetary policy. A strengthening dollar also puts a dent in corporate earnings, which isn't conducive to a positive economic outlook or higher asset prices.

4. The US is already paying the third highest interest rate in the G8, and is one of only three countries paying positive real rates on 10 year money (0.513%). The other two G8 nations without negative real interest rates are Italy (1.81%) and Russia (5.41%). Every other G8 nation is currently borrowing 10 year money at a negative real rate; i.e., they're borrowing $1 and paying back less than $1 at maturity, after discounting for inflation. If Fed policy continues to diverge from other major central banks, then rising debt servicing costs could become the most important fiscal issue in the US - something Powell likely wants to avoid at all costs.

Qualitative:

1. majority of market is on high alert/risk off and had a lot of time to settle into their thoughts over the weekend. They all fear a Monday gap-down and likely have stops in place to limit any potential downside in their portfolios.

2. Santa Clause Rally - we are currently in prime time for a holiday-fueled rally in stocks.

3. Trump leveling up public criticism of Fed policy.

4. The Perma-Bears are out in full force with more conviction than ever. From the Schiffs to the Stockmans - they've all published articles and videos over the weekend prophesying that last week's move is just the beginning of the end. This usually marks a near-term bottom. I wouldn't enter any new shorts while the bears have their chests puffed out.

Quantitative:

1. October's CPI came in 50% below forecasts. The CPI is the Fed's primary tool for gauging near term inflation, and a print 50% below expectations is not bullish for rates.

2. Jobless claims came in 7K higher than expected. One data point does not a trend make, however, it is technically inconsistent with a tightening labour market.

3. Strong dollar exacerbating slowdown in global growth. Since the Fed's dot plots imply a gradually strengthening dollar, current interest rate policy risks triggering a wave of emerging market debt defaults. Ironically, a slowdown in global growth itself ignites a flight to safety, strengthen the dollar further from here, irrespective of a change in monetary policy. A strengthening dollar also puts a dent in corporate earnings, which isn't conducive to a positive economic outlook or higher asset prices.

4. The US is already paying the third highest interest rate in the G8, and is one of only three countries paying positive real rates on 10 year money (0.513%). The other two G8 nations without negative real interest rates are Italy (1.81%) and Russia (5.41%). Every other G8 nation is currently borrowing 10 year money at a negative real rate; i.e., they're borrowing $1 and paying back less than $1 at maturity, after discounting for inflation. If Fed policy continues to diverge from other major central banks, then rising debt servicing costs could become the most important fiscal issue in the US - something Powell likely wants to avoid at all costs.

Sunday, 14 October 2018

Reasons to Doubt a Continuation of the Selloff

2712 = sp low for the week = ~1 stdev from the post-election mean regression. Fairly

orderly sell-off so far. Near-term downside from here is probably

limited. Market should chop sideways for at least a few weeks, as shorts pile in only to get squeezed and

shoestring longs sell out to limit losses.

Shorts have several reasons to be skeptical about a continuation of last week's selling.

A maxim of Jesse Livermore's evokes one of the many doubts one has in regard to the validity of last week's selloff:

Qualitative Factors

Firstly, the sharp, indiscreet nature of last week's selling may foreshadow an abrupt wash-out that precedes the annual Santa Clause rally. Stocks usually rally into the Christmas break and into the new year, as companies - primarily retail - get an earnings bump due to Holiday spending. Beginning the Santa Clause rally at all-time highs is a bit overstretched, considering valuations aren't exactly cheap. Last week's correction and close above the SMA200 provides the perfect launchpad to possibly retest all-time highs by year end.

Secondly, real unloading by the big hands is seldom done indiscriminately - let alone within a week's time. It's usually spread over weeks and months, in order to maximize gains and minimize losses, and reduce the overall effect that their own selling has on prices. Fundamental selloffs, or complete reversals in market sentiment, take place within an environment of consistent, controlled selling, marked by moderate rallies and tight daily ranges.

Finally - the market fearmongers have reemerged en mass. The Perma-Bears are out in full force with more conviction than ever. From the Schiffs to the Stockmans - they've all published articles and videos over the weekend prophesying that last week's move is just the beginning of the end. This usually marks a near-term bottom. I wouldn't enter any new shorts while the bears have their chests puffed out.

Federal Reserve in Spotlight

There are also four relatively recent factors that may cause the Fed to reconsider another rate hike in December: (1) Weaker than expected Consumer Price Index data for October: CPI ↑ 0.1% actual vs ↑ 0.2% expected; (2) Jobless claims came in 7K higher than expected; (3) The magnitude of last week's sell-off; (4) Trump's persistent public criticism of Fed policy.

The US is already paying the third highest interest rate in the G8, and is one of only three countries paying positive real rates on 10 year money (0.513%). The other two G8 nations without negative real interest rates are Italy (1.81%) and Russia (5.41%). Every other G8 nation is currently borrowing 10 year money at a negative real rate; i.e., they're borrowing $1 and paying back less than $1 at maturity, after discounting for inflation. If Fed policy continues to diverge from other major central banks, then rising debt servicing costs could become the most important fiscal issue in the US - something Powell likely wants to avoid at all costs.

A maxim of Jesse Livermore's evokes one of the many doubts one has in regard to the validity of last week's selloff:

"A market does not culminate in one grand blaze of glory. Neither does it end with a sudden reversal of form. A market can and does often cease to be a bull market long before prices generally begin to break."

Qualitative Factors

Firstly, the sharp, indiscreet nature of last week's selling may foreshadow an abrupt wash-out that precedes the annual Santa Clause rally. Stocks usually rally into the Christmas break and into the new year, as companies - primarily retail - get an earnings bump due to Holiday spending. Beginning the Santa Clause rally at all-time highs is a bit overstretched, considering valuations aren't exactly cheap. Last week's correction and close above the SMA200 provides the perfect launchpad to possibly retest all-time highs by year end.

Secondly, real unloading by the big hands is seldom done indiscriminately - let alone within a week's time. It's usually spread over weeks and months, in order to maximize gains and minimize losses, and reduce the overall effect that their own selling has on prices. Fundamental selloffs, or complete reversals in market sentiment, take place within an environment of consistent, controlled selling, marked by moderate rallies and tight daily ranges.

Finally - the market fearmongers have reemerged en mass. The Perma-Bears are out in full force with more conviction than ever. From the Schiffs to the Stockmans - they've all published articles and videos over the weekend prophesying that last week's move is just the beginning of the end. This usually marks a near-term bottom. I wouldn't enter any new shorts while the bears have their chests puffed out.

Federal Reserve in Spotlight

There are also four relatively recent factors that may cause the Fed to reconsider another rate hike in December: (1) Weaker than expected Consumer Price Index data for October: CPI ↑ 0.1% actual vs ↑ 0.2% expected; (2) Jobless claims came in 7K higher than expected; (3) The magnitude of last week's sell-off; (4) Trump's persistent public criticism of Fed policy.

The US is already paying the third highest interest rate in the G8, and is one of only three countries paying positive real rates on 10 year money (0.513%). The other two G8 nations without negative real interest rates are Italy (1.81%) and Russia (5.41%). Every other G8 nation is currently borrowing 10 year money at a negative real rate; i.e., they're borrowing $1 and paying back less than $1 at maturity, after discounting for inflation. If Fed policy continues to diverge from other major central banks, then rising debt servicing costs could become the most important fiscal issue in the US - something Powell likely wants to avoid at all costs.

Saturday, 13 October 2018

Crash Model Signal Week 3 Update

Dow down 1,572 points since twitter post below; SP down 185.

(12-Oct-2018 close: Dow 25,348; SP 2772)

(12-Oct-2018 close: Dow 25,348; SP 2772)

Friday, 12 October 2018

Ten Jesse Livermore Quotes

On the futility of causal analysis in trading

1. "The tape does not concern itself with the why and wherefore. It doesn’t go into explanations. I didn’t ask the tape why when I was fourteen, and I don’t ask it to-day, at forty. The reason for what a certain stock does today may not be known for two or three days, or weeks, or months. But what the dickens does that matter? Your business with the tape is now—not to-morrow. The reason can wait."

On Coming of Age

2. "Money got tighter...and prices of stocks lower. I had foreseen it...However, the real joy was in the consciousness that as a trader I was at last on the right track. I still had much to learn but I knew what to do. No more floundering, no more half-right methods. Tape reading was an important part of the game; so was beginning at the right time; so was sticking to your position. But my greatest discovery was that a man must study general conditions, to size them so as to be able to anticipate probabilities. In short, I had learned that I had to work for my money. I was no longer betting blindly or concerned with mastering the technique of the game, but with earning my successes by hard study and clear thinking."

On the importance of patience

3. A man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figured it must do. That is why so many men in Wall Street, who are not at all in the sucker class, not even in the third grade, nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight."

On learning through experience and studying your blunders

4. "If I learned...so slowly it was because I learned by my mistakes, and some time always elapses between making a mistake and realizing it, and more time between realizing it and exactly determining it."

On every trader's necessary tuition fee(s)

5. "Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it."

On living in the Now

6. "It isn’t uncomfortable to lose when the loss is not accompanied by a poignant vision of what might have been."

On self-reliance and position trading

7. "Another thing I noticed in studying my plays in Fullerton’s office after I began to trade less unintelligently was that my initial operations seldom showed me a loss. That naturally made me decide to start big. It gave me confidence in my own judgment before I allowed it to be vitiated by the advice of others or even by my own impatience at times. Without faith in his own judgment no man can go very far in this game. That is about all I have learned—to study general conditions, to take a position and stick to it. I can wait without a twinge of impatience. I can see a setback without being shaken, knowing that it is only temporary. I have been short one hundred thousand shares and I have seen a big rally coming. I have figured—and figured correctly—that such a rally as I felt was inevitable, and even wholesome, would make a difference of one million dollars in my paper profits. And I nevertheless have stood pat and seen half my paper profit wiped out, without once considering the advisability of covering my shorts to put them out again on the rally. I knew that if I did I might lose my position and with it the certainty of a big killing. It is the big swing that makes the big money for you."

On the fruitlessness of attempting to pick bottoms and tops

8. "One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world. They have cost stock traders, in the aggregate, enough millions of dollars to build a concrete highway across the continent"

On not losing even when you lose

9. "Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it."

On the subtlety between "trading" and "action"

10. "The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals."

1. "The tape does not concern itself with the why and wherefore. It doesn’t go into explanations. I didn’t ask the tape why when I was fourteen, and I don’t ask it to-day, at forty. The reason for what a certain stock does today may not be known for two or three days, or weeks, or months. But what the dickens does that matter? Your business with the tape is now—not to-morrow. The reason can wait."

On Coming of Age

2. "Money got tighter...and prices of stocks lower. I had foreseen it...However, the real joy was in the consciousness that as a trader I was at last on the right track. I still had much to learn but I knew what to do. No more floundering, no more half-right methods. Tape reading was an important part of the game; so was beginning at the right time; so was sticking to your position. But my greatest discovery was that a man must study general conditions, to size them so as to be able to anticipate probabilities. In short, I had learned that I had to work for my money. I was no longer betting blindly or concerned with mastering the technique of the game, but with earning my successes by hard study and clear thinking."

On the importance of patience

3. A man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figured it must do. That is why so many men in Wall Street, who are not at all in the sucker class, not even in the third grade, nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight."

On learning through experience and studying your blunders

4. "If I learned...so slowly it was because I learned by my mistakes, and some time always elapses between making a mistake and realizing it, and more time between realizing it and exactly determining it."

On every trader's necessary tuition fee(s)

5. "Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it."

On living in the Now

6. "It isn’t uncomfortable to lose when the loss is not accompanied by a poignant vision of what might have been."

On self-reliance and position trading

7. "Another thing I noticed in studying my plays in Fullerton’s office after I began to trade less unintelligently was that my initial operations seldom showed me a loss. That naturally made me decide to start big. It gave me confidence in my own judgment before I allowed it to be vitiated by the advice of others or even by my own impatience at times. Without faith in his own judgment no man can go very far in this game. That is about all I have learned—to study general conditions, to take a position and stick to it. I can wait without a twinge of impatience. I can see a setback without being shaken, knowing that it is only temporary. I have been short one hundred thousand shares and I have seen a big rally coming. I have figured—and figured correctly—that such a rally as I felt was inevitable, and even wholesome, would make a difference of one million dollars in my paper profits. And I nevertheless have stood pat and seen half my paper profit wiped out, without once considering the advisability of covering my shorts to put them out again on the rally. I knew that if I did I might lose my position and with it the certainty of a big killing. It is the big swing that makes the big money for you."

On the fruitlessness of attempting to pick bottoms and tops

8. "One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world. They have cost stock traders, in the aggregate, enough millions of dollars to build a concrete highway across the continent"

On not losing even when you lose

9. "Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it."

On the subtlety between "trading" and "action"

10. "The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals."

Tuesday, 2 October 2018

Tesla Could Be Ripe for a Short

[Note: This does not include Fundamental Analysis of Tesla. Public availability of all fundamental information, common knowledge of liquidity and solvency issues, reduces to zero the value-added of fundamental analysis, in this case]

Tesla [TSLA] (01-Oct-18) +17.35%

Rating N/A

Price (01-Oct-18, US$) 310.70

Target price (US$) 263.00

52-week price range (US$) 244.59 - 387.46

Market cap (US$ m) 52,870

Enterprise value (US$ m) 72,370

On Thursday of last week the SEC announces it has charged Elon Musk with Securities Fraud. By Friday, the stock closes down 15%, and before Saturday, Musk agrees to settle. At this point, the general consensus is Musk plans to fight it and it won't be pretty. The media receives the settlement surprise with such fanfare that they forget to weigh in on some important facts: 1. The settlement changes the image of the company and of the "founder;" 2. It changes the fundamental story behind the stock; 3. Musk is no longer Iron Man; 4. The stock is still under-performing the general market, and looks dead from a technical perspective; and 5. Musk is no longer Chairman.

There appears to be an excellent short term opportunity for shorts at yesterday's closing price of 310.70.

Market Sentiment/Catalysts

The SEC Settlement means Tesla may finally be a viable short. One key point that the market seems to be missing is that Tesla's and Musk's settlement takes away the surprise element or "x factor" of the story. Not only does an SEC charge look bad for the company, but the settlement could be even worse. With no settlement, at least the surprise element is still there. A big unknown. However, with a settlement, there really is no big unknown that exists about the company - at least not that involves any significant upside. The only unknown left is the DOJ's ongoing criminal investigation of Musk.

One of the greatest obstacles for shorts up to this point has been the upside risk in "the unexpected." Any day Musk could have come out with a surprise story about a trip to Mars or a new Tesla pick-up and the stock would rally almost systematically. However, much of the stock's reaction has to do with Musk's credibility and him eventually delivering. Now, after the settlement, the invisibility cloak appears to have been removed. There no more mystery to Musk. The fraud charge makes him awkwardly human. This, combined with the law of diminishing margins could be the combination needed to make the stock a viable short, particularly at the 310 level with a stop loss of 322, and a take profit at 263. Other than the risk of the high short interest and concentrated holdings, today's rally could provide the most favourable entry point in a while.

Settlement terms overlooked

Another aspect of the settlement that the market appears to be failing to appreciate is the fact that Musk is no longer Chairman of the Board. This makes one of the few CEOs of a Silicon Valley large cap that isn't both the CEO and Chairman. This also opens him up to termination once the new board members are elected. Depending on the share vote rules, a new Chairman will also prevent Musk from wielding control over the company, which puts his fate as CEO in the hands of someone other than himself. This makes him an employee--a position he likely doesn't plan to hold for a long time. Without Musk in as CEO the intangible value of the company is greatly reduced. Given the choice, Musk will likely choose his freedom over preventing the company from collapsing.

Technical aspects

- Significant resistance at the 320ish level.

- One-day rally with range > 2.5X 14-Day ATR.

- Large moves in either direction typically prove a successful fade the following day/week, for this stock.

- Since end of Q118, short interest shrank over 5%, from 30.9% to 25.73%, while the stock declined -3.57% during the same period (-5.32% YTD).

- Over 6M of the shares that have been purchased in the open market over the past six months is due to short covering.

- Aside from the price action that followed the going private tweet, bulls have made a number of unsuccessful attempts to push a weekly close above 322.

- Any support above the 322 level would need to be accompanied by a new narrative, which the company lacks for the foreseeable future.

A 17% move in one day is not healthy. In fact it's unhealthy. If a stock rallies 17% in day, you can be sure it isn't being accumulated by insiders. The guys who accumulate stock do so on the quiet and leave minimal forensic evidence. They also accumulate gradually, over a long period of time, at lower and lower prices. They're not in a race to buy and definitely don't bid their own stock up 17% in a day; they generally see that as an opportunity to sell into strength, if it can be done at a profit.

The stock has been too volatile even for day-traders. It's been a lose/lose for longs and shorts alike. However, the fundamental change in perception as a result of the SEC's charges has tainted the company and makes the narrative less compelling going forward. The out of the money call option that is Elon Musk and Tesla has shifted to an out of the money put option, and for the first time there appears to be more headwinds than tailwinds. The settlement with the SEC does not prevent further actions in the near future, the DOJ probe is a criminal probe which is far from over, and the company has a pile of debt maturing in early 2019 that it will likely default on sans an additional cap raise.

Who will be the new Chairman of the Board? Who will fill the two new board seats? Does the Settlement open Musk and Tesla up to more lawsuits? What will be the effect of the new communications limitations the SEC has placed on Musk? Will he stick around as an employee of Tesla or will his entrepreneurial spirit seek greener pastures? There are a lot of questions at this point, and none of them are bullish.

Tesla [TSLA] (01-Oct-18) +17.35%

Rating N/A

Price (01-Oct-18, US$) 310.70

Target price (US$) 263.00

52-week price range (US$) 244.59 - 387.46

Market cap (US$ m) 52,870

Enterprise value (US$ m) 72,370

On Thursday of last week the SEC announces it has charged Elon Musk with Securities Fraud. By Friday, the stock closes down 15%, and before Saturday, Musk agrees to settle. At this point, the general consensus is Musk plans to fight it and it won't be pretty. The media receives the settlement surprise with such fanfare that they forget to weigh in on some important facts: 1. The settlement changes the image of the company and of the "founder;" 2. It changes the fundamental story behind the stock; 3. Musk is no longer Iron Man; 4. The stock is still under-performing the general market, and looks dead from a technical perspective; and 5. Musk is no longer Chairman.

There appears to be an excellent short term opportunity for shorts at yesterday's closing price of 310.70.

Market Sentiment/Catalysts

The SEC Settlement means Tesla may finally be a viable short. One key point that the market seems to be missing is that Tesla's and Musk's settlement takes away the surprise element or "x factor" of the story. Not only does an SEC charge look bad for the company, but the settlement could be even worse. With no settlement, at least the surprise element is still there. A big unknown. However, with a settlement, there really is no big unknown that exists about the company - at least not that involves any significant upside. The only unknown left is the DOJ's ongoing criminal investigation of Musk.

One of the greatest obstacles for shorts up to this point has been the upside risk in "the unexpected." Any day Musk could have come out with a surprise story about a trip to Mars or a new Tesla pick-up and the stock would rally almost systematically. However, much of the stock's reaction has to do with Musk's credibility and him eventually delivering. Now, after the settlement, the invisibility cloak appears to have been removed. There no more mystery to Musk. The fraud charge makes him awkwardly human. This, combined with the law of diminishing margins could be the combination needed to make the stock a viable short, particularly at the 310 level with a stop loss of 322, and a take profit at 263. Other than the risk of the high short interest and concentrated holdings, today's rally could provide the most favourable entry point in a while.

Settlement terms overlooked

Another aspect of the settlement that the market appears to be failing to appreciate is the fact that Musk is no longer Chairman of the Board. This makes one of the few CEOs of a Silicon Valley large cap that isn't both the CEO and Chairman. This also opens him up to termination once the new board members are elected. Depending on the share vote rules, a new Chairman will also prevent Musk from wielding control over the company, which puts his fate as CEO in the hands of someone other than himself. This makes him an employee--a position he likely doesn't plan to hold for a long time. Without Musk in as CEO the intangible value of the company is greatly reduced. Given the choice, Musk will likely choose his freedom over preventing the company from collapsing.

Technical aspects

- Significant resistance at the 320ish level.

- One-day rally with range > 2.5X 14-Day ATR.

- Large moves in either direction typically prove a successful fade the following day/week, for this stock.

- Since end of Q118, short interest shrank over 5%, from 30.9% to 25.73%, while the stock declined -3.57% during the same period (-5.32% YTD).

- Over 6M of the shares that have been purchased in the open market over the past six months is due to short covering.

- Aside from the price action that followed the going private tweet, bulls have made a number of unsuccessful attempts to push a weekly close above 322.

- Any support above the 322 level would need to be accompanied by a new narrative, which the company lacks for the foreseeable future.

A 17% move in one day is not healthy. In fact it's unhealthy. If a stock rallies 17% in day, you can be sure it isn't being accumulated by insiders. The guys who accumulate stock do so on the quiet and leave minimal forensic evidence. They also accumulate gradually, over a long period of time, at lower and lower prices. They're not in a race to buy and definitely don't bid their own stock up 17% in a day; they generally see that as an opportunity to sell into strength, if it can be done at a profit.

The stock has been too volatile even for day-traders. It's been a lose/lose for longs and shorts alike. However, the fundamental change in perception as a result of the SEC's charges has tainted the company and makes the narrative less compelling going forward. The out of the money call option that is Elon Musk and Tesla has shifted to an out of the money put option, and for the first time there appears to be more headwinds than tailwinds. The settlement with the SEC does not prevent further actions in the near future, the DOJ probe is a criminal probe which is far from over, and the company has a pile of debt maturing in early 2019 that it will likely default on sans an additional cap raise.

Who will be the new Chairman of the Board? Who will fill the two new board seats? Does the Settlement open Musk and Tesla up to more lawsuits? What will be the effect of the new communications limitations the SEC has placed on Musk? Will he stick around as an employee of Tesla or will his entrepreneurial spirit seek greener pastures? There are a lot of questions at this point, and none of them are bullish.

Sunday, 30 September 2018

Weekly Update on the Tilray (TLRY) Pump and Dump

"There is very little altruism in finance. Wars against corporate managements take time, energy and money. It is hardly to be expected that individuals will expend all these merely to see the right thing done." -- Graham & Dodd, Security Analysis

Final Update: down -96% from ATH. What was foreseen has come to pass, and will happen again. The takeaway: There is nothing new under the sun, and least of all in the stock market. History doesn't rhyme in Wall Street - it repeats.

https://stocktwits.com/rwalton22/message/137982880 https://stocktwits.com/rwalton22/message/137982880

Exhibit #1 (9/12/2018):

Exhibit #2 (9/21/2018):

Wednesday, 19 September 2018

Heads Up for Tesla Bears

Now that Musk has the $3B funding (gap) secured for 2019 debt obligations via the SpaceX Moon Reservations, what's going to be even more impressive is how he'll manage to David Copperfield that cash onto Tesla's balance sheet.

TSLA shorts beware: Though the DOJ probe complicates an equity raise in the near future, that doesn't necessarily prevent the company from obtaining a bridge loan from a bank or hedge fund in the interim until the case(s) are settled.

The SpaceX Moon trip equity raise implies the 2019 $3.5B debt-service funding gap has been closed for the near term. Now the company is only short 2019 operating expenses.

Subscribe to:

Comments (Atom)