China winning the "trade war" is a bit like saying Musk is cashing out 100% of his $150B compensation package.

All Export nations want one thing: higher Terms of Trade (ToT).

ToT ↑ = good; ToT ↓ = bad.

ToT = Price of exports / Price of imports X 100.

China's ToT has been trending lower since the 2016 Presidential Election.

China ToT vs Imports '08 - '18:

Balance of Trade (in relation to 2016 US Presidential Election):

SSE50

Dow 30:

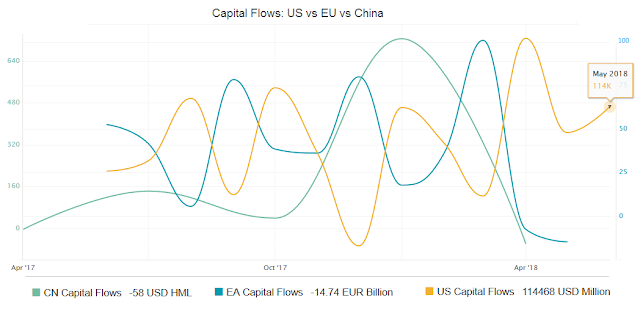

Global Capital Flows:

Yuan approaching 10-year high:

Aussie.

If 36% of Australia's exports go to China, and China is having a slow down, should that put upward pressure or downward pressure on aussie? What might this imply for AUD/USD, near term? The answer is pretty clear.

AUD/USD